I’m sure as hardworking moms, I don’t have to tell you that the holidays can be super stressful, but what if you could do one thing now that would mean your holidays will be less stressful next year? There’s one thing….and it’s something a lot of people aren’t willing to do, but pays off big time in reducing your stress at the holidays. It’s making a budget for Christmas.

Uugh…I know, I heard your collective groan, but stick with me for a minute. What stresses you the most at the holidays?

I’m willing to bet you either said time or money. (or maybe dealing with relatives ?)

Money doesn’t have to be stressful. I promise. I also know because I’ve been doing what I’m going to show you today for years. Now every year the holidays roll around I have zero stress about money and I end each holiday season with zero debt which equals no stress to carry over into the next year.

And it is so simple for you to do the same. It only takes a smidge of organization and planning. Let me show you.

How to Budget for Christmas:

Step 1: Track your spending this year

Download your budget for Christmas printables, they’re at the bottom of this post.

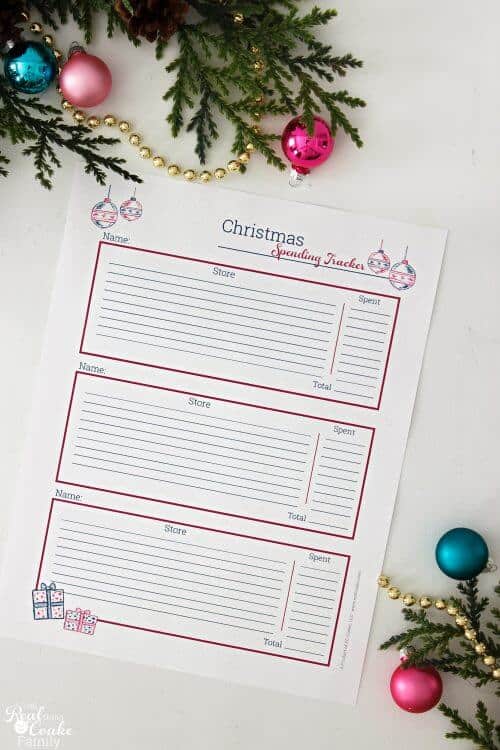

Start by writing down everything you spend this year. You’ll need to print a few copies of the spending tracker to track all the people you spend on.

Don’t forget to track things like decorations you buy or events you go to. Include anything that relates to the holiday season.

Your bank will most likely have a place you can look and see every transaction you’ve had. You can use that to help you remember things you’ve spent on before you started tracking.

Step 2: Total spending

Take each of tyour spending tracker sheets and total up what you spent on each person/category.

Take each of tyour spending tracker sheets and total up what you spent on each person/category.

Step 3: Decide who you’re spending on

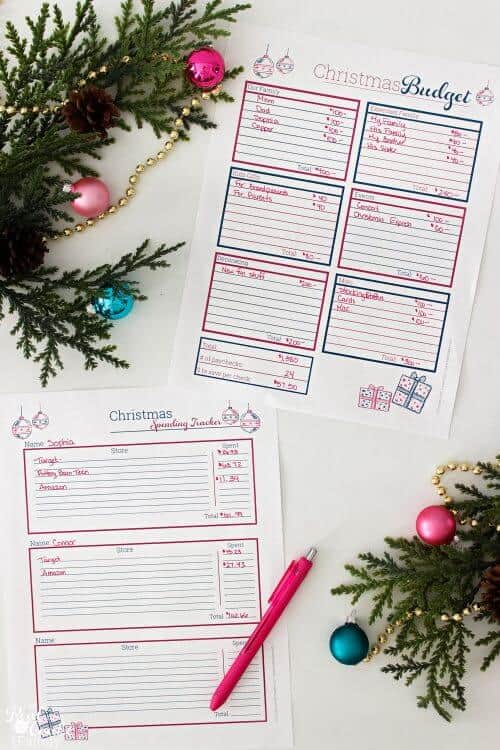

Now that you know what you spent on this year (or last year depending on when you’re doing this), you need to decide who you want to spend on this year. Page 2 of the budget for Christmas printable has the spot for you to write all this down. The worksheets are at the bottom of this post.

Maybe you realize that you spent WAY more than you thought you did going to Christmas concerts and poor Aunt Jo didn’t get a gift last year. Now is your time to plan who you want to be able to give a gift to next year. You may realize that your niece and nephew have so much stuff, they don’t need yet another toy from their Aunt and their gift will be coming over to bake cookies with you. That means you don’t need to save money for them next year.

I’m sure you get the point, but use this time to decide where you want to give and where you don’t want to. It’s OK to step off the gift hamster wheel and give from a great place versus obligation.

Step 4: Decide what you’ll spend on each person or category

Now that you know who you want to buy presents for next year, it’s time to combine the spending tracker and reality.

If you went into debt this year, you may need to make the hard choice to spend WAY less next year in favor of less stress and more financial freedom.

Take a look at your spending tracker and decide what you think is a reasonable amount to spend on each person, group or category.

Don’t forget to include things like decorations, activities, cards, stamps, and those pesky stocking stuffers.

Write them all down. Pencil is a great way to start so you can adjust things as you go.

Step 5: Total spending

Total up all your categories as well as a grand total.

Step 6: Figure paychecks for a year

Now, total up how many paychecks you get in a year and write that down.

If you’re starting after this Christmas total up the number of paychecks until the next Christmas.

I usually plan on my money being in my savings account by November 1st so I can start any shopping and I have the full amount to work with…but who am I kidding, Amazon Prime (affiliate link) for the last minute hardworking mom Christmas win! At any rate, I still have all the money there by November 1st.

You don’t have to do it that way but think about having the money saved up a little bit ahead of Christmas so it’s ready for you.

Step 7: Divide spending by paychecks

The last bit of math you need to do is to divide the total by the number of paychecks.

In my example above, it was $1380 divided by 24 paychecks. Which equals $57.50.

If the number you come up with isn’t realistic for your budget, then you need to change the amounts you plan to spend or cut a category or gift to make it something that’s do-able.

Step 8: Save that amount each paycheck

That means in my example, I need to save $57.50 from each paycheck to have enough money for next year. That’s very do-able.

There are 2 super easy ways to make sure you do that. Have the $57.50 automatically deposited from your paycheck into a savings account. It should be a pretty easy thing to set up. Or you can set up an automatic transfer from your checking account to your savings account.

I have a checking and savings account at the same bank, so it is super easy. I have the auto transfer set up for the 1st and the 15th of the month because paychecks come on the 15th and 31st. I don’t even think about the money being “gone.” It’s in the savings account and ready to go for the next holiday season.

Ladies, this is so easy! I promise you can do this and the freedom of knowing you have Christmas paid for is SO great! It definitely reduces my stress level each year to know that I’m all set and can have fun focusing on finding the perfect gift for those I love.

If you want to set up a budget for all year, check out my post on getting your money real organized.

Download your budget for Christmas worksheets below by signing in for your subscriber bonus.

Leave a Reply